Best pricing for Business loans in SE Florida 09/25/2015

September 25, 2015

6 secrets to negotiating the best deal on your commercial loan

October 12, 2015Does size matter? How the size of your bank could effect your chances of getting your business loan approved.

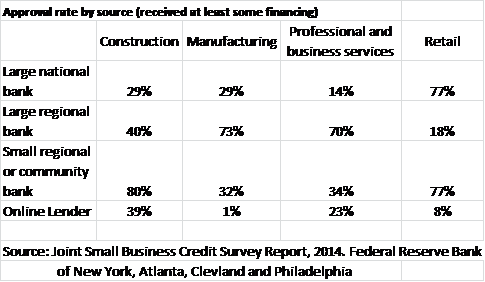

In a recent study conducted by the Federal Reserve Bank, when it comes to getting your business loan approved, the size of the bank can make a difference.

This annual survey is a great snapshot of what is happening with businesses located largely in the southeastern and northeastern part of the U.S.. The data from the survey is compiled by the Federal Reserve Banks of New York, Philadelphia, Atlanta, and Cleveland. Many local chambers of commerce and other non-profit local business support organizations helped in obtaining the data and sending it into the Federal Reserve Banks for analysis.

These regional annual surveys by the Federal Reserve Banks are heavily focused on examining business credit conditions.

The results of the study indicate that certain industries have a better chance at getting approved at certain size banks. As an example the chance of a retail store getting their business loan approved at a community bank was 77% vs 18% if they applied at a large regional bank. The surprising results, from over 1,000 businesses who applied for a business loan were as follows.

Although no reasoning was explained behind the results, some of the feedback from our contacts in the banking community were as follows.

Small banks love dirt. Construction industry loans normally have some type of “dirt” for collateral which for smaller banks is a great thing. Smaller banks love these real estate secured deals because it is viewed as a much safer loan. If the loan goes bad there is a valuable asset that can be sold to recoup this potential loss.

Many of these construction industry loans may not be able to show the historically strong cash flow that larger lenders want to see. The fact that the loan is secured, to these larger lenders, does not significantly change their loan decisions.

Manufacturing & Professional & Business Services. In both of these business sectors large regional banks showed an approval rate of 73% and 70% respectively which was more than double the approval rate of other size banks. Why?

Conventional wisdom in most industries would seem to tell us being in the middle (in this case regional banks) is the worst place to be. In commercial lending the small banks should be able to outmaneuver you and large national banks will outspend you in advertising and marketing. A large regional bank would seem to have no competitive advantage.

When it comes to these two business industries however large regional banks seem to be at the forefront of getting these loans approved.

There appears to be a combination of reasons why this is the case.

The quicker, smaller banks are being slowed down, more than larger banks, by the added new compliance burdens. Since smaller banks do not have the resources needed to comfortably approve the amount of these loan requests for these business sectors. Also the loans that they do approve for these business sectors tend to mostly be real estate secured transactions. The larger banks on the other hand can afford specialists in designated compliance departments who can focus more time and energy negating any potential regulatory audits.

Large national banks have been spending an inordinate amount of time warding off a public and political backlash that they are “too big to fail”. Cleaning the books of mountains of bad loans has also slowed them down from being as aggressive as regional banks in lending to manufacturing and professional service industries.

Regional banks when addressing these challenges are in much better shape. In addition there is a renewed appetite in regional banks to get back to blended balanced portfolio of loans. These regional banks are currently undersized in the manufacturing and professional and business service sectors. These sectors are wonderful underutilized markets that most lenders see as very profitable.

Doing loans for these local industrial and professional service businesses, allows regional banks to continue to safely grow while dialing back on past areas of loan growth (subprime and large development deals). The manufacturing industry in particular is very capital intense and this opportunity allows knowledgeable banks a solid window for growth, something regional banks currently seem more attuned to.

This “back to the basics” approach by large regional banks is helping them lead the way in approving these types of deals.

Retail. There appears to be a dumbbell effect with large national banks and small community banks outperforming other sized lenders. The approval rate for retail businesses is almost 60% higher by going with a small community bank or large national bank.

Large national banks historically have had an affinity for retail business loans. They can use their large advertising dollars to attract retail businesses and their market presence. They have branches within a close drive of most retail businesses, make them a convenient place to bank for most retail businesses where the business owner themselves are the ones making the deposits and doing the banking.

What greatly helps large national banks to approve such a large number of these retail loan requests is that these particular banks have the deep pockets that are needed to develop and implement complex automated underwriting programs. These loan programs, usually for smaller sized loans, allow lower-level bank employees to take applications and get approval without the need for a formal underwriting process. These loan programs tend to be much more aggressive than normal underwriting procedures.

Small community banks have their added edge in approving retail business loans because of their simplicity. Retail business loans are easy to understand. Besides their simplicity there is also more of a comfort feeling for approving retail business loans at small community banks. Primary because the lenders themselves or their bank employees, personal know the owners or they shop at the applicant’s store.

Will your chance of getting approved for a business loan mirror the above results? Like many things in life, change is constant and what one size bank likes today may be different tomorrow but this does provide an interesting snapshot of where we stand today.